Remodelers, specialty contractors remain a loyal purchasing group

“The Future of Remodeling” study, prepared by The Farnsworth Group, shows that remodelers are extremely influential in the products and finish materials used on remodeling projects, but just where are they making those purchases?

“Channel Purchase Behaviors for Consumers and Professionals,” a report prepared by The Farnsworth Group, answers this question.

Although this study addresses the purchasing habits of consumers, builders, remodelers and specialty contractor, this article will focus solely on the remodeling and specialty trade contractor.

Nearly half of the remodeler respondents—48 percent identified lumber and building material dealers as their primary outlet for material purchases, followed by 39 percent identifying warehouse home centers as their primary purchasing outlet and 11 percent identifying specialty wholesalers/distributors.

On the specialty contractor side, warehouse home centers and specialty wholesalers/distributors tied for the No. 1 spot of primary outlet with 38 percent, followed by lumber/building material dealers at 15 percent. Although both groups buy direct from the manufacturer (29 percent of remodelers and 26 percent of specialty contractors), it’s generally not their primary outlet or in the top three of their secondary outlet for purchases.

For a remodeler, the top reasons for choosing a top supplier included they have products in stock (68 percent), good selection/assortment of products (61 percent) and good customer service (57 percent). Reasons for the specialty contractors top supplier was the same, but in a different order: good selection/assortment of products (66 percent), have products in stock (58 percent) and good customer service, which also tied with convenient location for the No. 3 spot (46 percent).

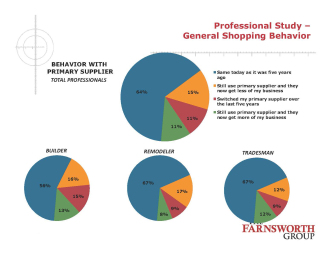

Remodelers are a loyal group, with 67 percent using the same primary supplier it did five years ago.

That primary supplier, by the way, is garnering 72 percent of the purchases on the remodeling side and 74 percent from the specialty trade contractor.

According to Grant Farnsworth, director of business development for The Farnsworth Group, “LBMs are still important for lumber. What’s interesting is the percentage at which they’re shopping at the big box stores and how will this change when the market comes back?”—Nikki Golden

If you’re interested in seeing the full report, you can contact Farnsworth at gfarnsworth@thefarnsworthgroup.com.

| 12/3/2013 12:00:00 AM |

0 comments