Homeowner Financing of Projects

How hard is it for homeowners to get financing for the remodeling project they want to undertake?

NARI’s Remodeling Business Pulse survey asked its research panel its opinion on that question in its 3rd quarter review. NARI’s research looks at the health of the remodeling industry and helps to educate legislators and regulators with credible information about our industry.

The results were interesting. NARI members who are involved with homeowners who need financing, placed it in a neutral to difficult range. None of the research panel members indicated that it was “very difficult” to get financing. And, about 30 percent indicated that it was either easy or very easy for its clientele to secure the needed funds.

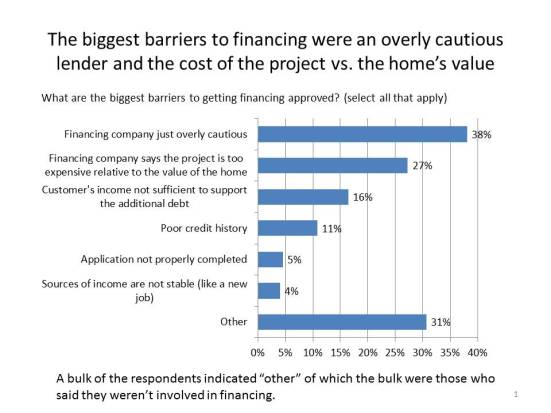

When asked about the biggest barriers to financing the top responses were:

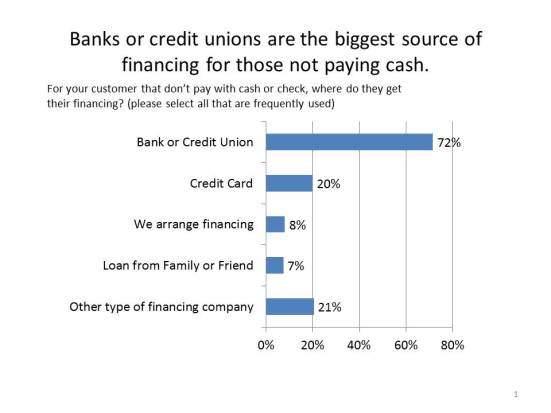

A bank or credit union was the dominant source of funds for financing that was used if cash or check was not used. This source 72% was reported by members vs. a credit card, the number 2 choice at only 20% .

The biggest barriers to financing were an overly cautious lender and the cost of the project vs. the home’s value.

An earlier NARI survey found that 96 percent of the NARI member contractors who completed the questionnaire had accepted checks as a form of payment. Approximately one-quarter had accepted credit cards, home equity loans, bank home improvement loans or cash, with only 6 percent arranging financing for their customer.

| 11/17/2014 12:00:00 AM |

1 comments