How to Turn Your Business Around Through Itemization

By Cole Stark, Reezy Founder

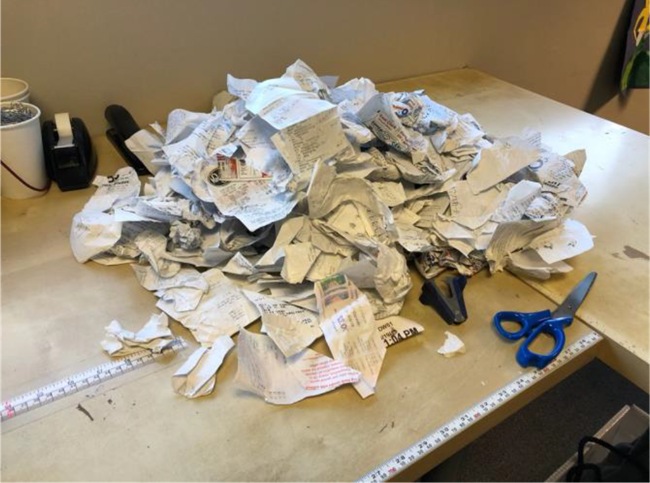

If you’re like me or many other home renovators, receipts are your worst nightmare. Collecting receipts and organizing them is such a hassle that most remodelers, myself included, toss the receipt and use the transaction data from their bank (merchant name, date, and total) for their financial accounting, providing a surface level understanding of your transactions. It looks a little something like what you see here.

Or if you happen to find yourself on the more cautious side, chances are you have a stack of receipts stashed away in a desk drawer- only taking them out for the dreaded “just in case” situations.

Well a few years ago I experienced the dreaded “just in case” situation that changed everything for my business. I found myself dusting off the cobwebs from my receipt collection not because a customer was questioning a charge

(although I had my fair share of those) but because my business was failing and I was desperate for a chance to cut costs.

Recognizing the downward trajectory of my business, my accountant (turned therapist) sat me down and told me that if I wanted to have a chance of saving my company, I needed to appreciate the power of receipts. He said that itemized data will allow me to:

- Accurately Calculate Projected Profitability

- Save Significant Capital From Tax Deductions

- Make More Money When Selling Homes

Now, years after that meeting with my accountant, I still send him gift cards to Outback Steakhouse (his favorite) because my company is still afloat due to his advice. Since I've been given a second chance, I feel it’s my duty to share these lessons so that your home renovation company can benefit the same way mine did.

Why Itemization is a Necessity

Accurately Calculate Projected Profitability

In the past, my mantra had been: if a client requested a project, I will handle the requests in the order that I receive them. I never thought to prioritize projects by the amount of time it would take vs. the profit I would receive. Why you ask? Because I couldn’t accurately calculate an estimate of what my profit would be. I’m not a robot, I don’t remember what everything costs!

This was one of the main reasons my accountant was adamant that I started inputting each item I bought into QuickBooks. “Now when you’re coming up with an estimate, you can look at the items (or similar items) you bought in the past and know their cost. Then you can calculate an accurate estimate and projected profitability per job”, he said.

This advice changed everything. Using accurate estimated profits, I could start calculating the profitability per day of a project and use that to determine the order in which I completed projects. For example:

- Job A has an estimated 10 days and has an estimated profitability of $8,000 ($800 per day)

- Job B has an estimated 2 days and has an estimated profitability of $3,000 ($1500 per day)

- I would prioritize job B first

Saving Money Using Itemized Tax Deductions

I’ve always claimed standard deductions for my taxes because frankly, it sounded easier.

I didn’t realize though that being a home renovator, chances are you would save MUCH more money following the itemized deductions route - since your total itemized deductions are probably higher than the standard deduction. Additionally, if you have a mortgage, that will most likely push your itemized deductions even higher.

- In my case, I was able to deduct approx. $10,000 more using itemized deductions than if I were to use standard deductions.

In order to follow the itemized deduction method, you have to total the tax deductible items and save your receipts for a minimum of 3 years (according to the IRS).

Home Improvement Deductions for Capital Gains

Being a home flipper who is constantly buying homes, this capital gains trick is something I wish I knew about way sooner.

I was able to save thousands once I realized that when selling a home, you can significantly reduce your capital gains taxes by including home improvement expenses.

- Capital gains = (selling price of home) - (original price of home) - ($250,000 if single or $500,000 if married) - (cost of any home improvements)

To deduct home improvement expenses, you must be able to prove the validity of the improvements by keeping your itemized receipts.

Other Benefits

- Billing Your Clients

- Now that I’ve gone all in on saving receipts, I’m able to send them to my clients when I am invoicing them for a job.

- They’ve greatly appreciated this tweak to my invoicing process as they no longer have to take my word for how much everything costs.

- Preventing Theft

- Because I’m organizing all my receipts and digitally itemizing them, I’m able to easily audit previous transactions and ensure there’s no funny business going on with my sub-contractors.

- According to financesonline.com, 95% of all business in the US have experienced employee theft

How Did I Make the Jump?

Once my accountant laid out all of these facts, it became obvious that I needed to start itemizing. However, taking pictures of each receipt, uploading and manually itemizing them to QuickBooks, then running reports based on itemized data proved to be very taxing, taking 5 to 10 hours each week.

I hated the time I was losing for this new expense management process, but I couldn’t find any alternatives. There were some software companies that helped with receipt management but none accurately itemized the receipt data, or grouped the receipts correctly - causing more harm than good.

With the lack of options, I decided to take matters into my own hands and build a software that would solve all of my needs, giving me those precious hours back. This software had to Automatically:

- Upload receipts into my QuickBooks accounts

- Itemize those receipts

- Remembers item costs for previously purchased items

- Group receipts into projects

- Link the original receipt to the transaction

- Enabling frictionless returns and auditing

After a lot of blood, sweat, and beers, my software is up and running on the QuickBooks app store. The software is called Reezy and it is giving those in the home improvement space (myself included) the crucial benefits of organized receipt information without sacrificing the time it takes to input it.

If these pain points resonate with you, you can go to tryreezy.com, book a demo with me, and I’ll walkthrough how the software can save your business the same way it did mine.

Regardless of what software you use, I can’t stress enough the importance of saving receipt information.

It’s pretty crazy how that hated piece of paper can hold the key to turning your business around. Learn from my mistakes and start saving your receipt information immediately. Not for “just in case” situations but for “just in time” opportunities.

| 10/24/2022 4:04:37 PM |

0 comments